Get Higher Life Insurance For Seniors Outcomes By Following 3 Easy Ste…

페이지 정보

본문

[Day]

In today's facility and unsure globe, making certain the economic safety and security of enjoyed ones is a top priority for In the event you cherished this information in addition to you would want to acquire details with regards to Life insurance advice i implore you to check out our web-site. numerous. Life insurance serves as a safeguard, supplying peace of mind and defense when faced with unforeseen situations. However, choosing the appropriate life insurance policy plan can be a complicated task. With various choices and differed benefits, it is vital to contrast plans extensively before making this significant economic dedication.

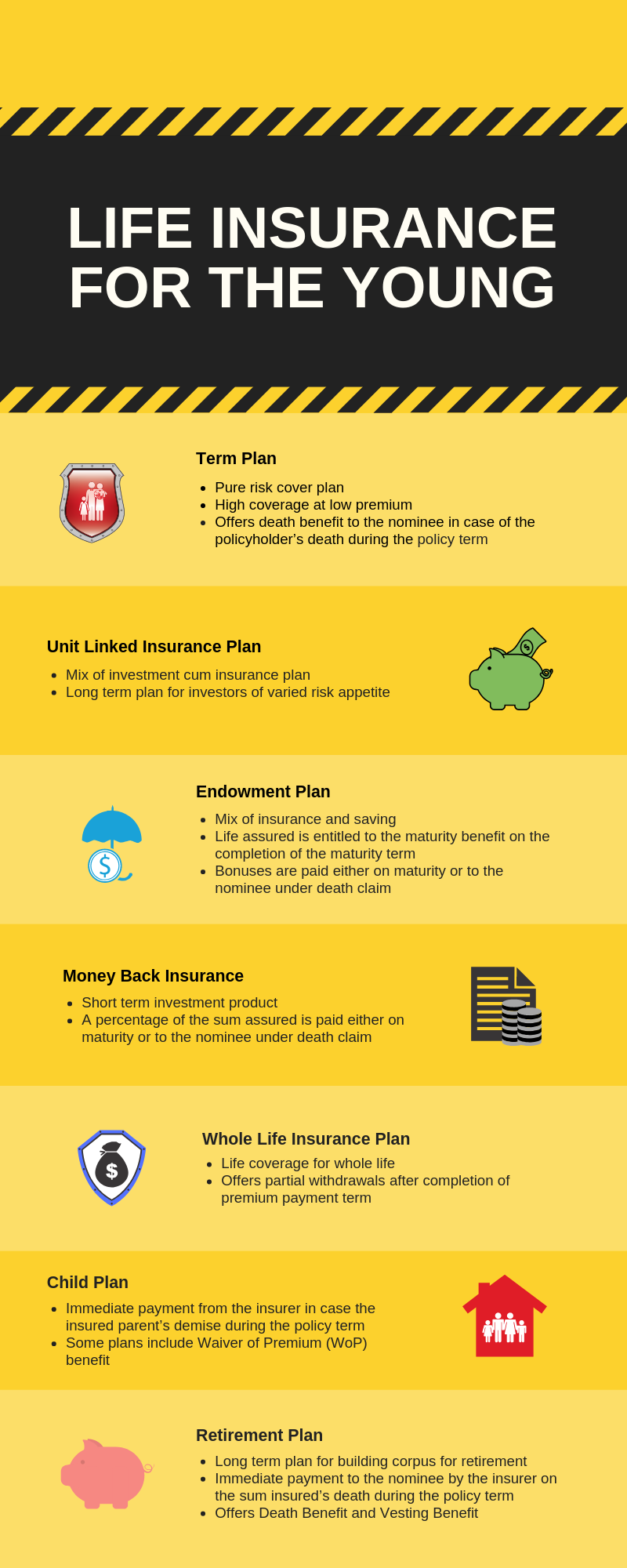

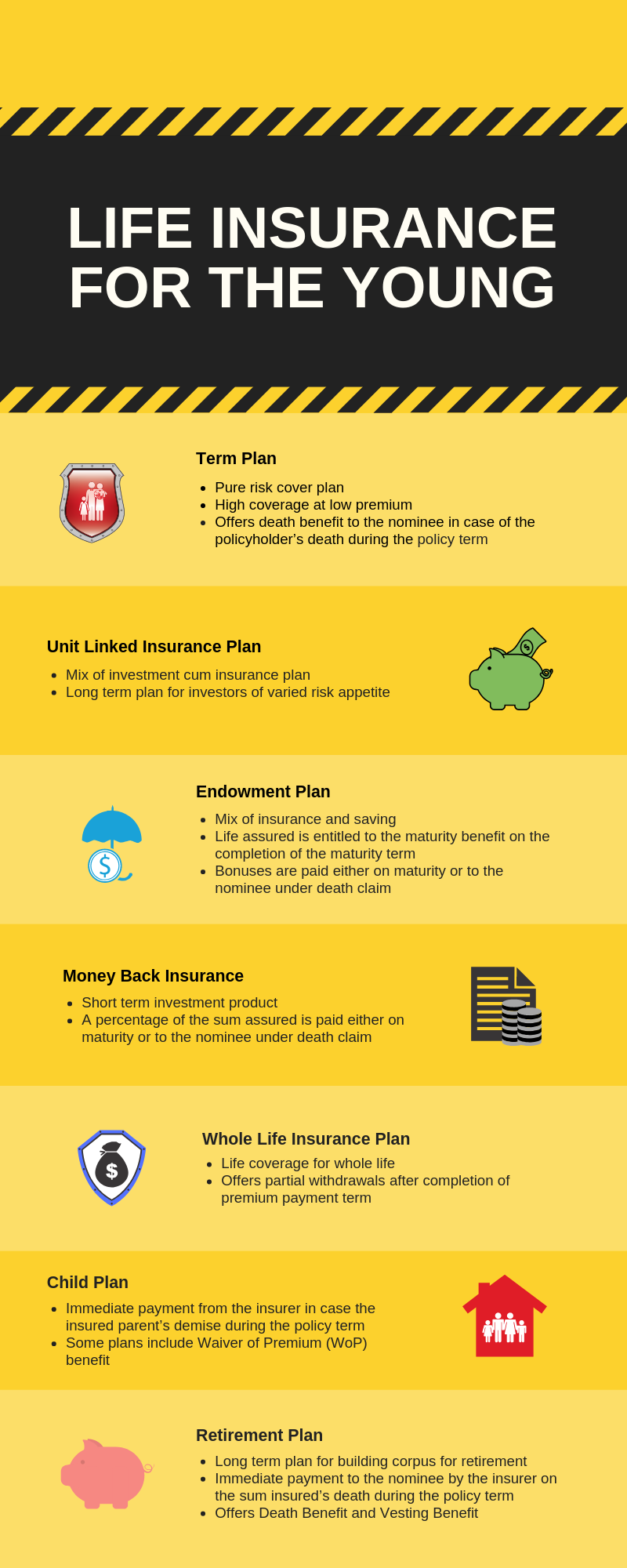

Among the main factors to take into consideration when comparing life insurance policy plans is the sort of coverage. Term life insurance policy and entire life insurance policy are both primary alternatives available to people. Term life insurance policy gives protection for a certain duration, frequently ranging from 10 to three decades. In comparison, whole life insurance policy supplies long-lasting protection incorporated with a financial investment component, building up cash money worth with time.

Among the main factors to take into consideration when comparing life insurance policy plans is the sort of coverage. Term life insurance policy and entire life insurance policy are both primary alternatives available to people. Term life insurance policy gives protection for a certain duration, frequently ranging from 10 to three decades. In comparison, whole life insurance policy supplies long-lasting protection incorporated with a financial investment component, building up cash money worth with time.

When reviewing insurance coverage, it is important to analyze personal demands and financial objectives. If the primary problem is securing dependents up until a certain milestone-- such as paying off a home Mortgage protection insurance or university costs-- term life insurance policy might be the preferable choice. On the other hand, whole life insurance policy provides long-term security and functions as a property, offering funds for retired life or serving as an inheritance for recipients.

One more critical element to contrast among plans is the premium framework. Term life insurance policy policies usually have actually reduced costs compared to whole life insurance policy plans, making them a lot more inexpensive in the short term. These costs continue to be continuous throughout the insurance coverage duration. In comparison, whole life insurance costs have a tendency to be higher; however, they also have the prospective to collect cash value in time. Some whole life policies even pay rewards, which can even more balance out premium prices.

It is crucial to review the conditions of each policy meticulously. Examining plan limitations, exclusions, and constraints will prevent any type of unpleasant shocks when it comes time to make a claim. Furthermore, discovering optional riders, such as crucial ailment or impairment coverage, can boost the general advantages of a Life insurance calculator insurance policy.

Effectively contrasting life insurance policy policies requires focus to information. Reviewing the financial security and credibility of the insurance policy provider is necessary for long-lasting stability. Researching sector ratings and consumer reviews can reveal important insights into a business's financial strength, client service, and declares handling effectiveness.

Utilizing online tools and resources can substantially improve the contrast procedure. Lots of sites use side-by-side comparisons of numerous Best life insurance UK insurance policy plans, allowing people to analyze costs, coverage information, and riders, done in one area. It is suggested, however, to cross-reference info from several resources to make sure accuracy and reliability.

Seeking the advice of an accredited insurance policy representative or monetary consultant can supply beneficial aid in browsing the intricacies of life insurance policy policies. These professionals have the knowledge and experience to examine individual circumstances and provide tailored advice to satisfy details requirements. They can aid determine spaces in protection, understand policy jargon, and provide clearness on any issues or inquiries.

Contrasting life insurance policy policies needs cautious consideration of personal conditions, monetary goals, and lasting purposes. By completely taking a look at protection options, superior structures, policy terms, and looking for professional guidance, people can make informed choices that provide one of the most ideal financial security. Remember, life insurance policy not just gives comfort yet likewise functions as an effective device to secure the wellness of enjoyed ones for generations to come.

One of the key factors to take into consideration when contrasting life insurance coverage plans is the kind of coverage. Term life insurance and whole life insurance coverage are the two main options available to individuals. Term life insurance coverage policies usually have actually reduced premiums contrasted to entire life insurance plans, making them extra budget-friendly in the short term. Several websites supply side-by-side comparisons of different life insurance coverage policies, permitting people to examine costs, coverage information, and bikers, all in one place. Looking for the advice of an accredited insurance agent or monetary advisor can offer beneficial help in navigating the complexities of life insurance policy plans.

In today's facility and unsure globe, making certain the economic safety and security of enjoyed ones is a top priority for In the event you cherished this information in addition to you would want to acquire details with regards to Life insurance advice i implore you to check out our web-site. numerous. Life insurance serves as a safeguard, supplying peace of mind and defense when faced with unforeseen situations. However, choosing the appropriate life insurance policy plan can be a complicated task. With various choices and differed benefits, it is vital to contrast plans extensively before making this significant economic dedication.

Among the main factors to take into consideration when comparing life insurance policy plans is the sort of coverage. Term life insurance policy and entire life insurance policy are both primary alternatives available to people. Term life insurance policy gives protection for a certain duration, frequently ranging from 10 to three decades. In comparison, whole life insurance policy supplies long-lasting protection incorporated with a financial investment component, building up cash money worth with time.

Among the main factors to take into consideration when comparing life insurance policy plans is the sort of coverage. Term life insurance policy and entire life insurance policy are both primary alternatives available to people. Term life insurance policy gives protection for a certain duration, frequently ranging from 10 to three decades. In comparison, whole life insurance policy supplies long-lasting protection incorporated with a financial investment component, building up cash money worth with time.When reviewing insurance coverage, it is important to analyze personal demands and financial objectives. If the primary problem is securing dependents up until a certain milestone-- such as paying off a home Mortgage protection insurance or university costs-- term life insurance policy might be the preferable choice. On the other hand, whole life insurance policy provides long-term security and functions as a property, offering funds for retired life or serving as an inheritance for recipients.

One more critical element to contrast among plans is the premium framework. Term life insurance policy policies usually have actually reduced costs compared to whole life insurance policy plans, making them a lot more inexpensive in the short term. These costs continue to be continuous throughout the insurance coverage duration. In comparison, whole life insurance costs have a tendency to be higher; however, they also have the prospective to collect cash value in time. Some whole life policies even pay rewards, which can even more balance out premium prices.

It is crucial to review the conditions of each policy meticulously. Examining plan limitations, exclusions, and constraints will prevent any type of unpleasant shocks when it comes time to make a claim. Furthermore, discovering optional riders, such as crucial ailment or impairment coverage, can boost the general advantages of a Life insurance calculator insurance policy.

Effectively contrasting life insurance policy policies requires focus to information. Reviewing the financial security and credibility of the insurance policy provider is necessary for long-lasting stability. Researching sector ratings and consumer reviews can reveal important insights into a business's financial strength, client service, and declares handling effectiveness.

Utilizing online tools and resources can substantially improve the contrast procedure. Lots of sites use side-by-side comparisons of numerous Best life insurance UK insurance policy plans, allowing people to analyze costs, coverage information, and riders, done in one area. It is suggested, however, to cross-reference info from several resources to make sure accuracy and reliability.

Seeking the advice of an accredited insurance policy representative or monetary consultant can supply beneficial aid in browsing the intricacies of life insurance policy policies. These professionals have the knowledge and experience to examine individual circumstances and provide tailored advice to satisfy details requirements. They can aid determine spaces in protection, understand policy jargon, and provide clearness on any issues or inquiries.

Contrasting life insurance policy policies needs cautious consideration of personal conditions, monetary goals, and lasting purposes. By completely taking a look at protection options, superior structures, policy terms, and looking for professional guidance, people can make informed choices that provide one of the most ideal financial security. Remember, life insurance policy not just gives comfort yet likewise functions as an effective device to secure the wellness of enjoyed ones for generations to come.

One of the key factors to take into consideration when contrasting life insurance coverage plans is the kind of coverage. Term life insurance and whole life insurance coverage are the two main options available to individuals. Term life insurance coverage policies usually have actually reduced premiums contrasted to entire life insurance plans, making them extra budget-friendly in the short term. Several websites supply side-by-side comparisons of different life insurance coverage policies, permitting people to examine costs, coverage information, and bikers, all in one place. Looking for the advice of an accredited insurance agent or monetary advisor can offer beneficial help in navigating the complexities of life insurance policy plans.

- 이전글The Nuiances Of 宜蘭外燴 24.08.13

- 다음글This Is The Ultimate Cheat Sheet On Adhd Assessment Adult 24.08.13

댓글목록

등록된 댓글이 없습니다.